Assembling a well-rounded portfolio of rental vehicles is crucial for maximizing profits and minimizing risk.

By diversifying your fleet across vehicle types, classes, and acquisition strategies, you can appeal to a wider customer base, optimize pricing tiers, and withstand changes in demand.

This article explores tips for crafting a balanced and lucrative portfolio car rental.

Take Inventory of Current Assets

Start by auditing your current rental fleet. Make a list of each vehicle with details like make, model, year, class, mileage, purchase price, and accumulated rental income. This provides an overview of what asset types you already have in inventory so you can identify gaps.

Look for imbalances or overconcentration in certain vehicle classes. For example, having too many luxury sedans and not enough economy cars leaves you exposed if demand shifts towards budget rentals.

Spread Risk Across Vehicle Types

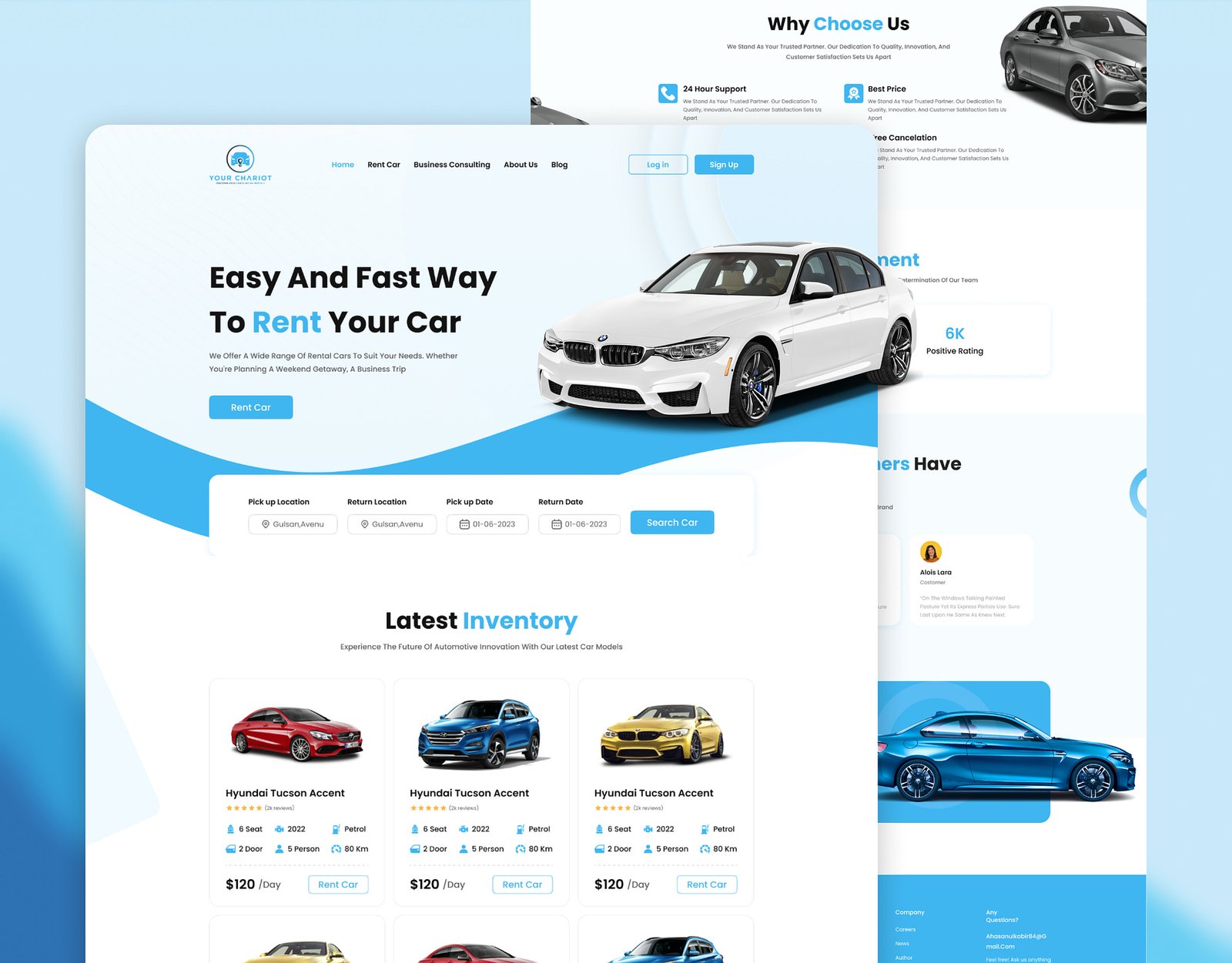

A diversified portfolio should include a healthy mix of:

Cars: Both economy compacts for budget travelers and mid-size sedans for families or business renters. Cover mainstream brands like Toyota, Nissan, and Ford which have wide appeal.

SUVs: Standard SUVs like the Toyota RAV4 can serve solo travelers while larger 7-8 passenger SUVs accommodate bigger groups.

Vans: Cargo and passenger vans enable contractors, moving customers, and large families. Include minivans and full-size options.

Specialty vehicles: Unique assets like convertibles, pickup trucks, or luxury cars can demand higher pricing from niche travelers.

Mixing vehicle types ensures you have rentals available for all customer segments and mitigates risk tied to fluctuations in any one category.

Stratify Across Rental Classes

Segment your fleet across clearly defined rental classes or “tiers” differentiated by price point, features, and comfort. Common rental classes are:

- Economy– Most affordable cars perfect for budget shoppers

- Compact– Smaller cars with better mileage than full-size

- Intermediate– Mid-size sedans ideal for most renters

- Standard– Full-size cars with maximum space and features

- Premium/Luxury– Upscale models from luxury brands

Having select high-end luxury vehicles lets you command premium pricing from affluent renters. But focus more heavily on economy and intermediate cars which have broader demand.

Balance Newer and Older Models

Acquire both newer current model year vehicles which can charge higher daily rates, along with reliable older models from 3-5 years ago.

Newer cars attract renters who want the latest features and style. However, proven older models with 50-70k miles can still rent consistently without succumbing to major maintenance costs. This blend maximizes profits while controlling fleet costs.

Diversify Acquisition Sources

Expand inventory by pulling from diverse sourcing channels:

- Buy from dealershipsto get newer models with manufacturer incentives

- Purchase at auctionsto find off-lease or used vehicles at large discounts

- Lease through manufacturersto get new cars with lower upfront costs

- List on Turoto earn income from privately owned vehicles

Purchasing solely from dealerships is costly. Mix up acquisition approaches to get pricing and availability advantages. Listing personal or Turo vehicles also taps into supplemental income streams.

Cater to Local Demand Trends

Research area-specific travel patterns and tourist segments to select assets aligned with local demand. For a market with lots of families, focus on minivans and SUVs. Near corporate centers, sedans and economy cars may see more bookings.

Adjust your evolving portfolio based on real-time rental performance data and changing local traveler demographics.

Manage Vehicle Turnover

Don’t keep aging rental cars in service forever. As vehicles reach 4-6 years old with 75-100k miles, cycle them out of rental duty and sell them direct to consumers or at auctions.

Use sale proceeds to invest in new replacement unit types currently in demand. This turnover propagates a healthy portfolio lifecycle.

Carefully crafting a diverse rental fleet across vehicle categories, classes, ages, and acquisition sources takes work…but pays major dividends through amplified earnings, smoothed demand fluctuations, and minimized risk exposure. Follow these portfolio management strategies and you’ll be rewarded with a lucrative rental asset mix built to profit.